Our suite of state-of-the-art technology will allow you to leverage our tools to grow your business vigorously and efficiently! We invest in your success at EMM Loans LLC!

At EMM Loans we offer one of the most robust product offerings in the industry to ensure you and your clients have what you need to be successful! We are a direct lender to Fannie Mae with minimal overlays as well a multiple niche broker outlet. We have a loan for that!

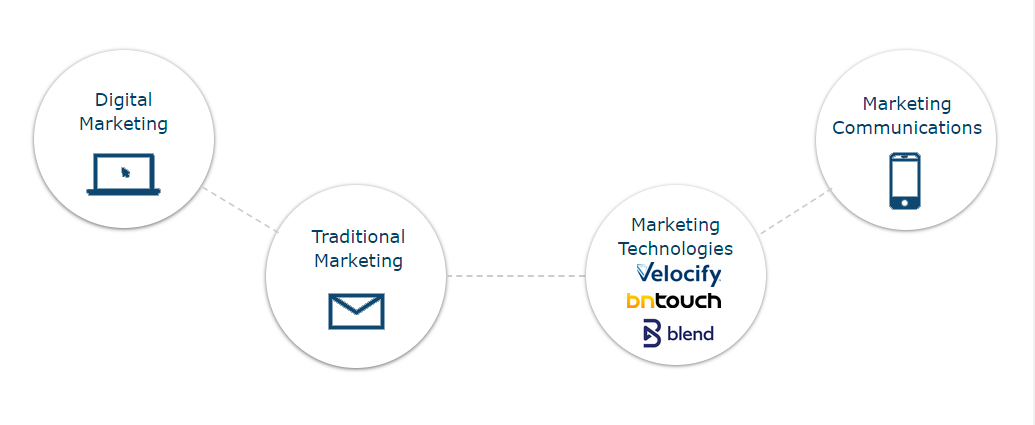

Our black-box, think-tank team creatively develops traditional and digital content, which is strategically designed to attract and engage Borrowers, Employees and Industry Partners alike, converting each into EMM Raving Fans as we build a positive culture and sustainable brand reputation while expanding our footprint in the marketplace.

Our goal is to make the process seamless to both our internal and external customers while providing the best experience possible. Unlike most companies we do not believe in a one size fits all. We want your input as a mortgage professional on what has worked best for you in your career.

Underwriting has many important customers. It’s not only our Sales and Processing Teams but the broker and the agent as well. Although it can be easy to create a Raving Fan when a loan is approved, our intent is to generate fans even when the answer is not as easy. Our mission is to be a resource and to work collaboratively with our partners, both internally and externally.

It is the duty of operations to serve the Team Members of EMM working loans from the point of Disclosures through Post Closing. Our interaction includes both internal and external team members as well as external partners who assist us in closing loans for our borrowers.

Fortren Funding a division of EMM Loans LLC’s Secondary Marketing Department handles all lock requests and is responsible for working with investors to make sure that our origination sources have all the products and best execution available. We understand that the Secondary mortgage market is constantly evolving and we strive to be at the forefront of this evolution.

Our mission is to strengthen the company’s ability to deliver exceptional service to customers, consumers and fellow associates by developing an engaged, high-performance workforce. We do this through organizing and facilitating various training sessions and methods to expedite the acquisition of the knowledge, skills, and abilities required for effective job performance. Providing employees with career growth opportunities consistent with corporate goals, objectives, and strategies.

We also recognize how vital it is for you to not miss a beat with your clients and partners by providing comprehensive onboarding support coupled with our robust ambassador support team that will allow you to make the transition with ease and confidence. Our extensive employee resource portal and best in class Licensing and IT team will have you up and running in no time. You will also feel the comfort of having a dedicated support team to provide guidance throughout your career. We give you the power to be awesome and ensure your success making this the only career move needed!

Provide a positive experience through onboarding and training of new hires

Come join a company that really cares about its employees! Here at EMM, we offer the following:

The HR Department is committed to providing our employees with a stable work environment with equal opportunity for learning and personal growth. Creativity and innovation are encouraged for improving the effectiveness of EMM Loans LLC. Above all, employees will be provided the same concern, respect and caring attitude within the organization that they are expected to share externally with every customer.

Finance: This offer is not guaranteed if you do not continue to meet EQ Loans criteria and other factors bearing on your credit worthiness (including acceptable property collateral, income, assets and employment history). Not all applicants will qualify for the rate and monthly payment shown. Monthly payments do not include property taxes, property insurance, and homeowners association dues. Your exact loan’s interest rate and payments will depend upon the term of your loan, your credit history, and other qualifying factors. To qualify for a mortgage, borrowers must be U.S. citizens or permanent residents, and meet Eq Loans underwriting and Investor requirements. Loans valid for the refinance or purchase of an owner-occupied residence. Loan amounts range up to $2,000,000 for Jumbo and at or under conforming loan limits within your state and county for conventional and government sponsored programs. Rate subject to change depending time of rate lock. Call 844-390-5978 for exact details and qualifying information.

Refinance: By refinancing your existing loan, your total finance charge may be higher over the life of the loan.

Encompass LOS

Blend Point Of Sale

Blend Point Of Sale

Office 365

Optimalblue

Velocify

Regardless, we will ensure a harmonious integration with our highly experienced processing leadership so your clients and partners will be Raving Fans. We do this by keeping all participants in the transaction up to date with timely status, proactively identifying any challenges, being the subject matter experts, and working relentlessly to bring the file to the closing table expeditiously.

Our goal is to be consistent, collaborative and reliable. Everyone is accessible and we welcome the questions and feedback that come with this role. Although we may sometimes have to deliver a “no”, we will escalate, consider options, call investors or research alternative products before that “no” becomes final. Our team is dedicated to providing the highest level of service to all of our customers.

Everyone in Operations understands that part of their job is customer service and the expectation is that we treat fellow Team Players with respect, smile over the phone, provide quick turn times for questions, escalations and execute on our normal process flows.

Although our interaction with the borrower is limited it is important how we treat our fellow Team Members so the loan process happens in an efficient and smooth manner for all involved.