If you’re a homebuyer who has been riding out the downward trajectory in interest rates and trying to time the bottom to get the best possible deal on your home financing, it’s time to make your move. Recent data suggests we have seen the bottom and that rates are already moving upward from here.

Driven by growing confidence in our economy now that the Covid-19 pandemic is on the wane, long-term treasury rates have risen significantly in recent weeks, putting upward pressure on mortgage rates. Additionally, with the $1.9 trillion stimulus bill recently passed, there are worries that inflation, which has remained subdued the last several years, might heat up as the economy continues to recover. This too puts upward pressure on rates as investors look for returns that will outpace inflation.

What Are the Current Mortgage Rates?

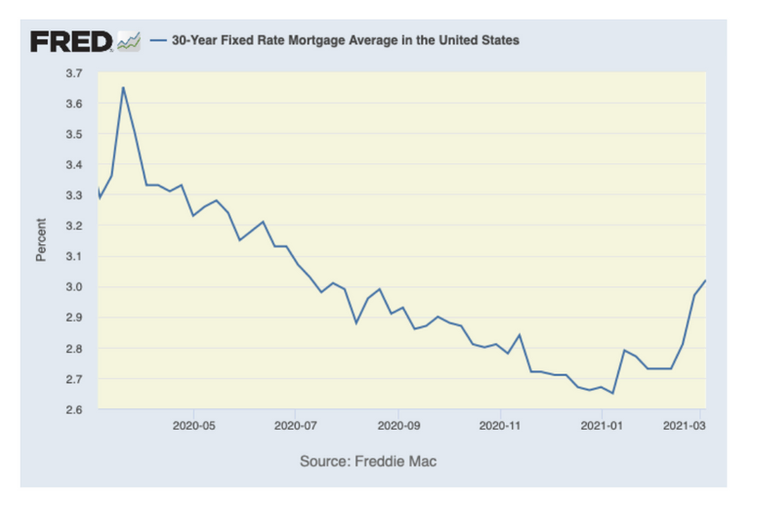

At the start of March 2021, the average 30-year fixed mortgage rate was 3.02%, according to Freddie Mac. Since reaching a low point of 2.65% in January, rates have risen more than 37 basis points (a basis point is one-tenth of a percentage point) peaking at over 3% for the first time since July of 2020.

To put this in perspective, if you took out a 30-year loan for $350,000, the 37-basis point difference would mean an additional payment of $69 per month and an additional interest payment of $24,847 over the life of the loan. Seeming small changes in interest rates can have significant long-term effects.

Is Now Still a Good Time to Buy a Home?

That isn’t to suggest that now isn’t a good time to buy a home. While rates have started to rise, they are still near historical lows. This means that your earnings will be able to qualify for a higher purchase price than at most other times.

To find out how much you can qualify for, it is important you talk to one of our loan advisors today! Call 1-800-793-9633 or contact us online.